Content

These accounts sweep excess cash into an interest-bearing account and then return this excess cash to the operating account when it’s time to pay bills. A current ratio of less than 1 means the company may run out of money within the year unless it can increase its cash flow or obtain more capital from investors. A company with a high current ratio has no short-term liquidity concerns, but its investors may complain that it is hoarding cash rather than paying dividends or reinvesting the money in the business. If a company has $2.75 million in current assets and $3 million in current liabilities, its current ratio is $2,750,000 / $3,000,000, which is equal to 0.92, after rounding. In simplest terms, it measures the amount of cash available relative to its liabilities.

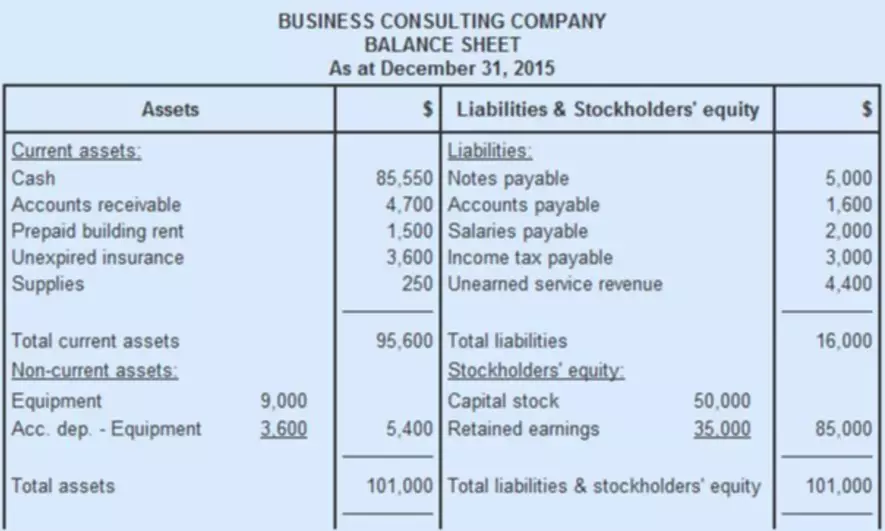

The current assets are cash or assets that are expected to turn into cash within the current year. In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation. Meanwhile, an improving current ratio could indicate an opportunity to invest in an undervalued stock amid a turnaround. Now that you know the current ratio, you can use it as part of your analysis of the company. The following section explains exactly how to use the current ratio in your analysis.

Current Ratio vs. Quick Ratio

The fact that it is not doing so could be signs of mismanagement or inefficiency. Current assets are assets that can be converted to cash easily within a one-year period or less. Examples of current assets include cash, cash equivalents, marketable securities, accounts receivable, and inventory, which are examples of current assets. Also called the acid test ratio, a quick ratio is a conservative measure of your firm’s liquidity because it uses a fraction of your current assets. Unlike current ratio, quick ratio calculations only use quick assets or short-term investments that can be liquidated to cash in 90 days or less.

- However, an excessively high current ratio may indicate that a company is hoarding cash instead of investing it into growing the business.

- Since the Food & Hangout outlet’s ratio is more than 1, it will certainly get the loan approval.

- Also, being able to barely cover all of a business’ current liabilities with its current assets, with nothing left over, isn’t exactly an indicator of a healthy business.

- A current ratio of less than 1 means the company may run out of money within the year unless it can increase its cash flow or obtain more capital from investors.

- If the ratio is below 1, the company’s current liabilities are greater than its assets.

- This article will discuss the current ratio formula, interpretation, and calculation with examples.

Anything lower indicates that a company would not be able to pay its obligations. You can calculate the current ratio by dividing a company’s total current assets by its total current liabilities. Again, current assets are resources that can quickly be converted into cash within a year or less. The current ratio compares a company’s current assets to the debts that it will have to pay within the year. It is simply calculated by dividing a company’s total assets (cash and easily convertible assets) by its short-term debts (accounts payable for the year). Once you’ve calculated the current ratio, you can draw inferences about the company.

See if you’re eligible for business financing

The current ratio is used to evaluate a company’s ability to pay its short-term obligations, such as accounts payable and wages. The higher the result, the stronger the financial position of the company. Working Capital is the difference between current assets and current liabilities. A business’ liquidity is determined by the level of cash, marketable securities, Accounts Receivable, and other liquid assets that are easily converted into cash. The more liquid a company’s balance sheet is, the greater its Working Capital (and therefore its ability to maneuver in times of crisis).

As an example, let’s say The Widget Firm currently has $1 million in cash and easily convertible assets (e.g., inventory) and $800,000 in debts due in the year (e.g., payroll and taxes). Otherwise referred to as the “acid test” ratio, the quick ratio’s distinction from the current ratio is that a more stringent criterion is applied for the current assets included in the calculation. Now, even though a higher current ratio could be favorable to investors and creditors, it’s important to note that an unusually high ratio is also an indicator that the company is underutilizing its current assets.

Current Ratio Analysis

Similar to the current ratio, which also compares current assets to current liabilities, the quick ratio is categorized as a liquidity ratio. They want to calculate the current ratio for the technology company XYZ Ltd which is based in California. The company reports show they have $500,000 in current assets and $1,000,000 in current liabilities. The current ratio is a liquidity ratio used to determine a company’s ability to pay off current debt obligations without raising external capital.

- Upon dividing the sum of the cash and cash equivalents, marketable securities, and accounts receivable balance by the total current liabilities balance, we arrive at the quick ratio for each period.

- The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

- Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

- Bankrate.com is an independent, advertising-supported publisher and comparison service.

- While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

- If a company has a current ratio of 100% or above, this means that it has positive working capital.

In other words, it is defined as the total current assets divided by the total current liabilities. Business owners and the financial team within a company may use the current ratio to get an idea of their business’s financial well-being. Accountants also often use this ratio since accounting deals closely with reporting assets and liabilities on financial statements.

Debt-to-equity ratio

It’s an important measure of liquidity because using short-term assets is better than having to sell long-term and possibly revenue-generating assets. While indicating the short-term solvency, the current ratio indicates the presence of current assets in rupees for every rupee of current liabilities. A ratio of more than one in current ratios means a firm has more assets than liabilities usable in the shorter term.

If the current ratio is close to five, for instance, that means the company has five times as much cash on hand as its current debts. While the company is obviously not in danger of going bankrupt, it has a huge amount of cash or easily convertible assets simply sitting in its coffers. It could hire more employees, build a new facility or expand its product line.

What are assets?

Current assets (also called short-term assets) are cash or any other asset that will be converted to cash within one year. You can find them on the balance sheet, alongside all of your business’s other assets. The current ratio can be useful for judging companies with massive inventory back stock because that will boost their scores. On the other hand, the quick ratio will show much lower results for companies that rely heavily on inventory since that isn’t included in the calculation. In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio.

- The current ratio is calculated simply by dividing current assets by current liabilities.

- The more liquid a company’s balance sheet is, the greater its Working Capital (and therefore its ability to maneuver in times of crisis).

- The inventory turnover ratio is the cost of goods sold divided by average inventory.

- In fact, if your company has significant inventory balances, you may want to use the acid test ratio alongside the current ratio in evaluating your company’s short-term liquidity.

- Current assets consist of cash and assets like accounts receivable and inventory that a business expects to convert to cash within the next year.

Large retailers can also minimize their inventory volume through an efficient supply chain, which makes their current assets shrink against current liabilities, resulting in a lower current ratio. However, because the current ratio at any one time is just a snapshot, it is usually not a complete representation of a company’s short-term liquidity or longer-term solvency. The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. Although industry standards vary, it’s generally safe to say that a company’s current ratio should be at the very least 1.0.

Current ratio vs. quick ratio vs. debt-to-equity

It is used to determine whether the current assets of a firm would be sufficient to pay off its current obligations or not. In other words, it is used to depict the magnitude of current assets against current liabilities of a concern. In Year 1, the quick ratio can be calculated by dividing the sum of the liquid assets ($20m Cash + $15m Marketable Securities + $25m A/R) by the current liabilities ($150m Total Current Liabilities). The Quick Ratio measures the short-term liquidity of a company by comparing the value of its cash balance and liquidated current assets to its near-term obligations. In Year 1, the current ratio can be calculated by dividing the sum of the liquid assets by the current liabilities. Either liquidity ratio indicates whether a company — post-liquidation of its current assets — is going to have sufficient cash to pay off its near-term liabilities.

What is an ideal current ratio?

A current ratio of 2:1 is considered ideal in many cases. This means that the current assets can cover the current liabilities two times over.

The current assets and current liabilities are listed on the company’s balance sheet. These current assets include items such as accounts receivable, cash, inventory, and other current assets (OCA) that are expected to be liquidated or turned into cash within a year. The current liabilities, on the other hand, include wages, accounts payable, short-term debts, taxes payable, and the current portion of long-term debt. This ratio compares a company’s current assets to its current liabilities, testing whether it sustainably balances assets, financing, and liabilities.

Sustainable Investing Topics

Everything is relative in the financial world, and there are no absolute norms. If a company has a current ratio of 100% or above, this means that it has positive working capital. The current ratio is a rough indicator of the degree of safety with which short-term credit may be extended to the business. On the other hand, the current liabilities are those that must be paid within the current year. However, similar to the example we used above, there can be special circumstances that can negatively affect the current ratio in a healthy company.